Financial Abuse: The Invisible Companion of Domestic Violence

Economic abuse is defined as When an abuser;

- controls access to shared or individual assets,

- limits the current or future earning potential of the victim,

as a strategy of power and control.

What’s the scary thing about financial abuse?

Unlike physical and sexual abuse that leave physical evidence behind, financial abuse is a different ballgame altogether. This is because the victim may not even realise it is happening. Over the years, the abuser will ensure the control shifts entirely to him. This gradual loss of control is made worse by the fact that by in India, many women are ignorant about in handling money matters. They realise what is happening when they see that they are unable to access funds, accounts have been wiped out, money has been lost.

Are Indians aware of this problem?

The National Family Health Survey (2019-20), collects data for gender based violence from all states of India, but does not even consider financial abuse. In India, since the responsibility for money matters lies with the husband or the father-in-law, financial dependence of women is normalised. Traditionally, the power over a woman must be exerted by someone else from the time of her birth- transferred from first her father, to her husband and ultimately to her son, according to archaic texts like the Manusmriti, which sadly continue to influence subaltern culture even today. For women and for persons from lower castes/classes, actual equality is still a pipe dream.

Understanding Financial Abuse

In abusive relationships, it’s about exerting control and power over the victim. It follows a cyclical pattern: violence, silence, honeymoon period, tension, again followed by violence or abusive behaviour.

Men who economically abuse women can be divided into 3 types:

- preventing women from acquiring resources (control)

- preventing women from using resources (sabotage)

- exploiting women’s resources. (exploitation)

It is important to learn how to recognise the signs:

- The Abuser.

- Constant monitoring of your bank account expenditure- the victim must justify the purchase of each item, giving receipts of the same. This makes the victim feel they are not trustworthy/ their judgement is not good enough and requires approval.

- Transfers ownership of assets into the abuser’s name alone.

- The abuser may take out loans either jointly with the victim, or wholly in her name and may not explain his reasons for the same.

- Abuser will hide how he manages the family expenses- not disclose important details.

- If the victim has no daily source of income, the abuser may make her feel like she cannot contribute to running the house, despite her performing the role of a housewife.

- The Victim

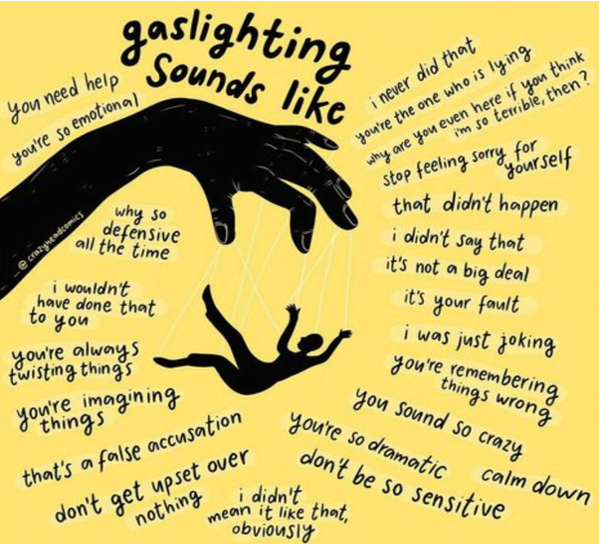

- Due to constant gaslighting, have low self-esteem, low confidence and low sense of self-worth, helplessness.

- She will doubt the abuse even happened.

- Stress, Anxiety, Depression, PTSD-increased risk of mental disorders.

- Increased risk of substance abuse

- Have trouble making decisions, or setting healthy boundaries.

- Will make excuses for the abuser, expect him to get better and change his behavior, defend his behavior to others by saying its stress-induced, or temporary.

Strategies to Empower the Victim

Victims need to be made aware of the options they have available to them. Some ideas can be-

- Identify ways for them to access their money.

- Start setting aside small amounts of money in preparation for leaving.

- Begin to take financial literacy classes.

- Re-establish contact with family and friends, that she may have become distanced from during the abusive relationship and take their help.

- Exploring options for legal aid- there are many domestic abuse helplines that will aid survivors and provide them shelter.

Need for a Systemic Overhaul

The empowerment of women in India is a political act of bravery and courage. It is an act of resistance against the patriarchal culture that constantly demands obedience from subservient women. And like all change, it must be implemented across all generations. From childhood, girls need to be taught how to be financially independent. This means:

- Inclusion of finance as a compulsory subject in CBSE curriculums, regardless of whatever stream the child may choose- Arts, Business or Science. This must begin from Class 5, and continue till graduation. The syllabus can begin with small, introductory concepts and gradually expand to more complex topics. This should include how to file taxes, accounting, the basics of investment and saving, and portfolio management.

- High schools rarely have investment/finance societies, and those who do, focus on quizzes. There should be an investment culture from a young age.

- For working women, they should be encouraged to go for finance classes and manage their income gainfully.

- Lastly, on a societal level, in addition to legal and financial services, what needs to be addressed is the gender, socio-economic and ethnic inequalities that make women vulnerable to economic abuse in the first place.

Cover Illustration: metro.co.uk

Author